What is a Donor-Advised Fund?

Create a Donor-Advised Fund

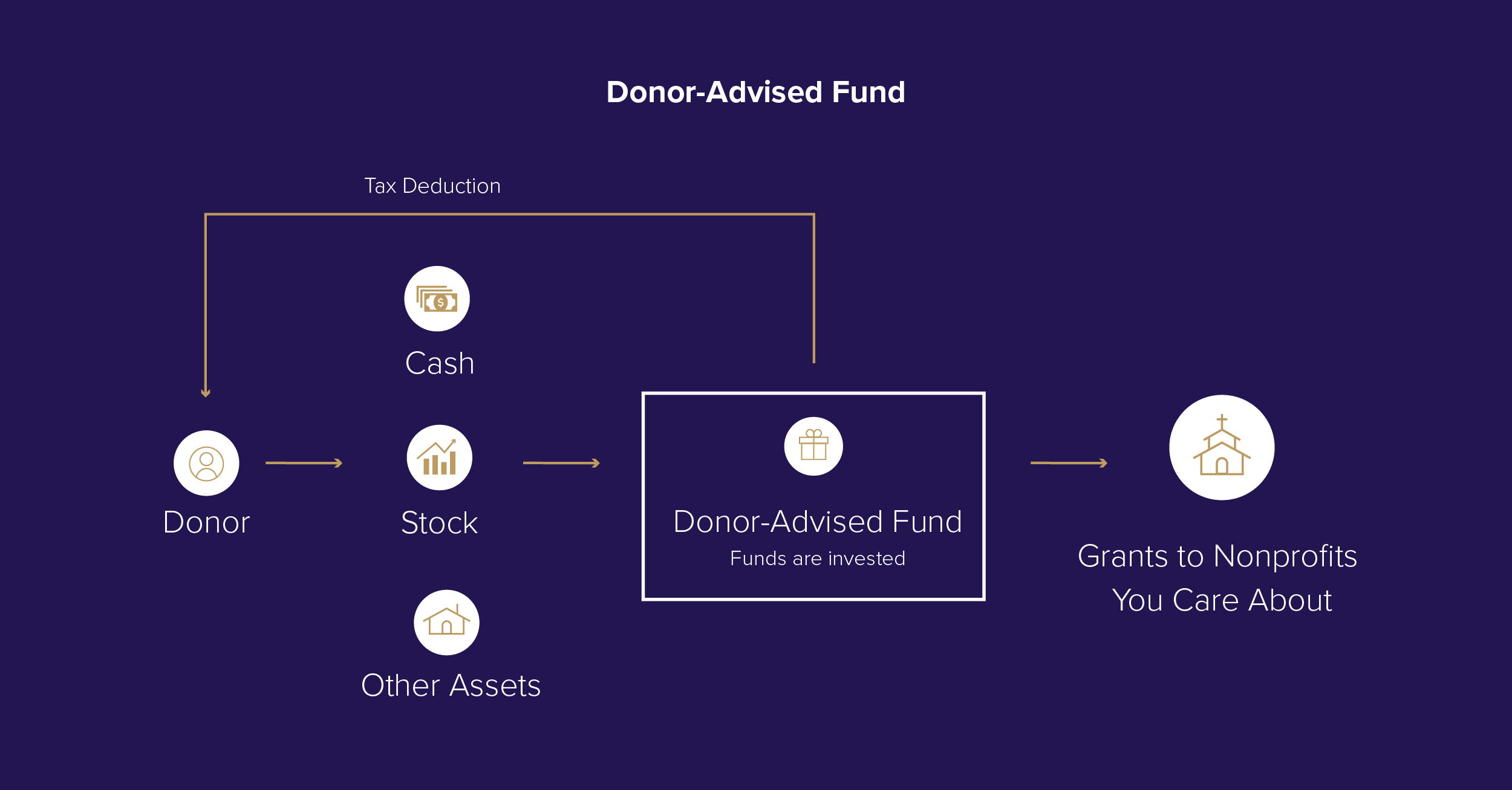

A donor-advised fund can provide immediate tax benefits while making charitable giving more accessible in future years.

How it works

You establish and name your fund at TMF and make an initial contribution to the fund of cash or appreciated assets such as stocks or mutual funds valued at $10,000 or more and receive an immediate income tax deduction.

Once established, you can suggest that your favorite charities, such as your church, receive grants from your fund. Grants amounts can be relatively modest or more significant for projects such as contributing to a capital campaign or new building.

You can also suggest which charities you want to have any remaining assets in your fund at your passing.

If you are considering establishing a donor-advised fund, please contact our team.

Establish a Donor-Advised Fund

The donor-advised fund (DAF) is becoming an increasingly popular way to make a charitable gift. A DAF can provide immediate tax benefits while making charitable giving more accessible. Here are two simple ways you can make a gift through your DAF:

- Make an outright gift by suggesting a grant to TMF.

- Designate TMF to receive all or a portion of the fund value upon the fund's termination.

You can select the option that best suits your philanthropic and financial goals to support the TMF. Contact your fund administrator to request a distribution or beneficiary form or download the appropriate form(s) from your administrator's website.

If you include TMF in your plans, please let us know and use our legal name and federal tax ID.

Legal Name: Texas Methodist Foundation

Address: 11709 Boulder Lane, Suite 100, Austin, Texas 78726-1808

Federal Tax ID Number: 74-1363741